The steep fall prompted a former pensions minister to call for a national inquiry into the impact on company pensions of the Bank of England’s new £70bn bond-buying plan, launched to stimulate the economy amid fears of a Brexit-related slowdown.

“The Bank wants to stimulate the economy by bringing down interest rates, but the Bank is not acknowledging the negative impact these measures are having on pension deficits, and neither is the government,” said Ros Altmann, the minister under David Cameron.

Pension funds are some of the largest investors in British government bonds, which they believed would offer a safe and reliable source of income that can be used to pay out future benefits to retirees.

Central bank largesse pins down euro zone bond yields

The Bank of New Zealand, one of 55 global central banks that have eased policy since the beginning of 2015 in the face of slowing growth and inflation, is set to cut rates on Thursday, while the ECB is broadly expected to ease in September.

As earnings stagnate, U.S. companies looking to charge up their stock returns with repurchases are turning to debt markets like no time since the dot-com bubble. Led by Apple Inc. and CBS Corp., S&P 500 constituents have rushed to sell bonds to finance the repurchases of their own stock. The proportion of buybacks funded by debt rose above 30 percent in June for the first time since 2001, data compiled by JPMorgan Chase & Co. and Bloomberg show.

The ECB started buying bonds issued by euro zone companies - provided that they have at least one investment grade rating and are not banks - on June 8 in a bid to stimulate hiring and investment by lowering borrowing costs for firms.

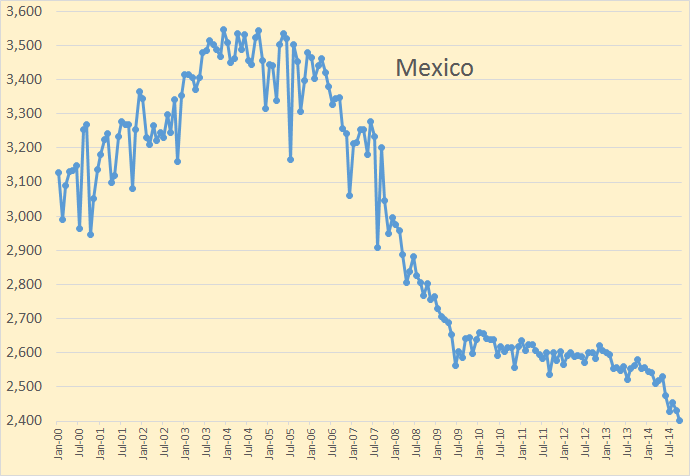

Can Mexico Reverse Its Steep Output Decline?

The petroleum industry in Mexico dates back over a century to 1901 where the commercial production of crude oil began. Since then, both Great-Britain and the United States played major roles in helping the country grow to being the world’s second largest producer of oil in the 1920s. The Mexican revolution caused major political unrest, and led to the nationalization of all hydrocarbon resources and the creation of the national oil company, PEMEX, in 1938.

Today, approximately 50 percent of oil produced in Mexico is heavy crude, and Mexico is now the eighth largest oil producer in the world, exporting $18.8 billion worth of crude oil in 2015. PEMEX produced about 2.23 Mbbl/day in February 2016, down from its peak of 3.4 Mbbl/day in 2004, of which about 76 percent of production comes from offshore fields. The Northeast region consists of the Ku-Maloob-Zaap (KMZ) and Cantarell field, which contribute […]

Today, approximately 50 percent of oil produced in Mexico is heavy crude, and Mexico is now the eighth largest oil producer in the world, exporting $18.8 billion worth of crude oil in 2015. PEMEX produced about 2.23 Mbbl/day in February 2016, down from its peak of 3.4 Mbbl/day in 2004, of which about 76 percent of production comes from offshore fields. The Northeast region consists of the Ku-Maloob-Zaap (KMZ) and Cantarell field, which contribute […]