“I am not particularly troubled by the level of equity values overall. They are certainly higher than normal but in a world where financial market assets are expected to give low returns, P/Es should be high,” he said.

According to a survey of 1,000 adults released by Bankrate.com on Tuesday, nearly one in three (29%) American adults (that’s roughly 70 million) have no emergency savings at all — the highest percentage since Bankrate began doing this survey five years ago.

The ECB's balance sheet is steadily increasing as it rolls out a roughly 1 trillion euro scheme to buy government bonds and other assets known as "quantitative easing".

Loan delinquencies at Brazilian banks rose in May for a second straight month, the latest sign that companies and individuals are struggling to remain current on their credit as Latin America's largest economy deteriorates.

Beijing is permitting provinces to issue at least 2.6 trillion yuan ($419 billion) in bonds in 2015, the first local-government issuances in more than 20 years, to stave off a debt crunch. Local administrations have accumulated some 18 trillion yuan in bank loans and bonds to fund risky land and property deals—equivalent to a third of China’s economy. As the real-estate market slows, state-owned banks that did much of the lending are on the hook.

Regulations enacted since the global financial to make banks sound and prevent an implosion of the money market mutual fund industry have left less short-term debt instruments, such as bills and repurchase agreements, available. The shift has come while the U.S. Treasury reduces the amount of bills sold in favor of longer-maturity debt as part of plan to lock in lower borrowing costs with interest rates lingering close to historic lows.

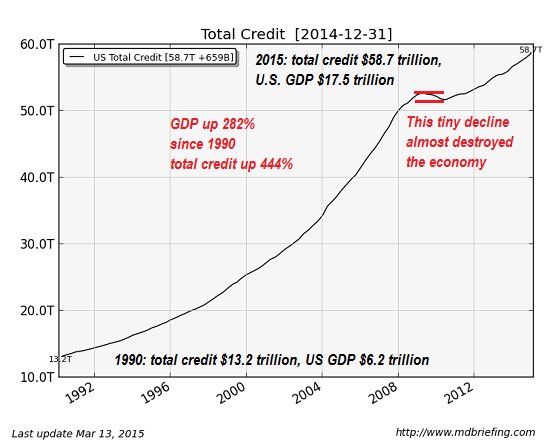

Collapse Part 3: No Institutional Path to Contraction

Collapse is not an event, it is a process.

One poorly understood source of collapse is the lack of pathways to contraction and a reduction of complexity/cost. The only pathway that is clearly marked is the one to expansion--of production, debt, credit, government, income, benefits, costs and complexity: more agencies, more regulations, more committees, more staff, more of everything.

The path to less complexity, less debt, less production and a contraction of the entire system doesn't exist in most institutions.

Top Weekly Ideas and Insights

The Extinction Debate